What Tolerance Does the Consorcio of Compensation Apply to Underinsurance?

Fecha: 2025-10-09

You sign up for an insurance policy, pay your premiums, and believe that you’ll be protected against whatever comes. Then a catastrophic event happens — flood, earthquake, extreme wind — and you learn that your claim will be handled not by your insurer, but by the Consorcio de Compensación de Seguros (the Spanish public insurance backstop).

When you file the claim… you’re surprised. The compensation is much smaller than you expected. Why? Because you are in a state of underinsurance.

But isn’t the Consorcio public? Shouldn’t it pay the full loss?

In this article we’ll explain how the Consorcio handles the concept of tolerance for underinsurance, when it applies the proportional rule, and how a reduced indemnity due to underinsurance can come about.

What is the Consorcio de Compensación de Seguros?

The Consorcio de Compensación de Seguros (CCS) is a public entity under Spain’s Ministry of Economy that acts as an “insurer of last resort” for certain extraordinary risks that private insurers do not cover, such as:

Floods

Earthquakes

Volcanic eruptions

Extreme wind or storms

Acts of terrorism, riots, or civil unrest

However, the Consorcio only intervenes when you held a valid insurance policy at the time of the event, since it is funded via a mandatory surcharge embedded in every Spanish insurance policy.

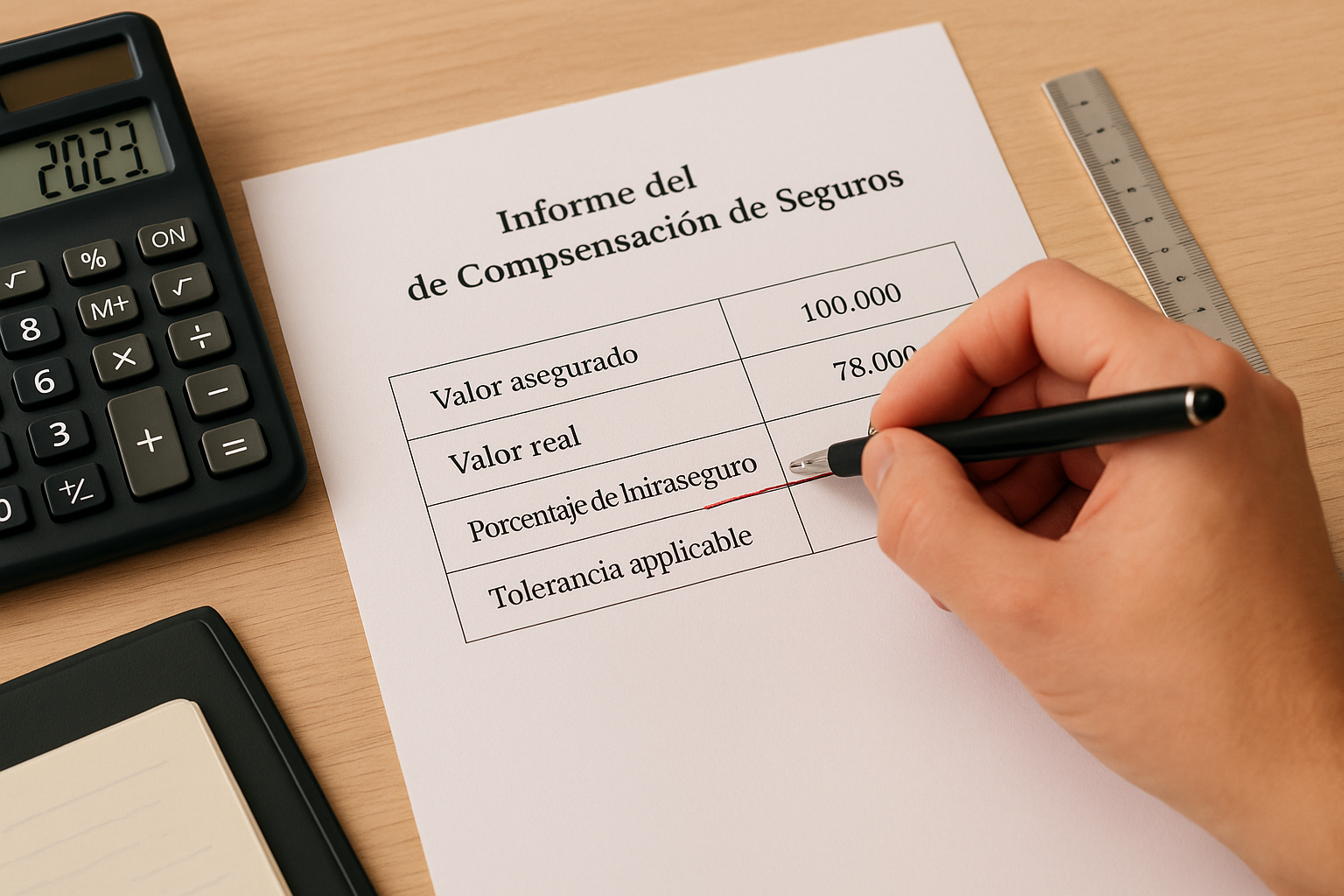

What Is Underinsurance and How Is It Treated?

You are underinsured when the sum insured in your policy is lower than the real value of the insured asset.

In those cases, both private insurers and the Consorcio may apply the proportional rule:

If you insure only part of the real value, your compensation will be proportionally reduced.

Simple example:

Real value: €100,000

Insured value: €70,000

Loss: €50,000

After proportional rule: compensation = €35,000

You lose part of the recovery simply because you underinsured.

How Does the Consorcio Act on Underinsurance?

This is where the tolerance clause comes in.

Unlike many private insurers, the Consorcio grants a margin of tolerance before applying the proportional rule.

What does that mean?

If the insured amount is at least 90% of the real value, the Consorcio waives the proportional deduction.

So if the underinsurance is 10% or less, the proportional rule is not applied.

The 10% Tolerance of the Consorcio

The Consorcio does not apply the proportional rule if the difference between the insured amount and the real value is within 10%.

In other words:

If you insure at least 90% of the real value, you’re safe from reduction.

Example:

Real value: €100,000

Insured amount: €92,000

Underinsurance: 8% → proportional rule not applied

But if the insured amount were €85,000 (i.e., 15% underinsurance), then the deduction would kick in.

Why Does This Tolerance Exist?

The Consorcio recognizes that perfect valuations are often difficult, especially with older policies or properties whose conditions change over time.

This margin exists to:

Avoid unfair penalties for minor valuation errors

Not impose disproportionate reductions over small mismatches

Encourage fairness in compensation under extraordinary loss events

What If the Underinsurance Exceeds 10%?

If the underinsurance exceeds 10%, the Consorcio will apply the proportional rule in full.

Example:

Real value: €150,000

Insured amount: €120,000 (20% underinsurance)

Loss: €90,000

Compensation = 90,000 × (120,000 / 150,000) = €72,000

You would lose €18,000 due to underinsurance.

How Does the Consorcio Assess Insured Value?

The Consorcio considers:

The policy’s declared sum insured

The property type and its features

Documentation provided: plans, appraisals, cadastral records, estimates

The real reconstruction value in case of buildings or premises

Hence the importance of keeping your policy accurately updated and well valued.

How to Avoid Reduced Compensation Due to Underinsurance

Here are practical steps:

Accurately calculate the real reconstruction value of your property.

Include all constructed elements (garage, pool, porches).

Update your policy if you make renovations or improvements.

Avoid declaring a lower value just to reduce premium — it’s a false saving.

Seek professional help to value what should be insured.

At MataSeguros, we review your policy and help ensure you are properly insured. If you’ve already suffered a claim, we assist in seeking the compensation you deserve.

Contact us — we only charge if you are compensated.

FAQs

Does the Consorcio always allow 10% tolerance? Yes, but only up to that margin. If the shortfall is 11% or more, reductions apply.

Does this apply to homes, commercial premises, vehicles? Yes. The tolerance is generally applicable to all assets covered by the Consorcio, provided conditions are met.

What documents support a real value claim? Construction estimates, appraisals, cadastral records, contractor quotes, technical reports.

Can you challenge the Consorcio’s proportional adjustment? Yes — via administrative appeal, judicial route, or professional assistance.

Conclusion

The Consorcio’s 10% underinsurance tolerance is a valuable protection for policyholders, ensuring minor underestimations are not punished in extraordinary events.

But when you exceed that threshold, penalty kicks in.

Thus, proper valuation is essential to secure full coverage when you need it most.

At MataSeguros, we’ll help you validate your policy and fight for the maximum indemnification — with no upfront charge.