Partial reopening of a business after a claim: when loss of profit exists even if the business is open

When a serious loss occurs —a fire, a flood or a DANA event— many businesses are forced to reopen before they are truly operational. Not because everything is fixed, but because they cannot afford to stay closed any longer.

This is where one of the most common conflicts with insurers arises:

“If the business is open, there is no loss of profit.”

Reality is very different. A business can be open to the public and still suffer a real loss of earnings, which may be covered by the insurance policy.

In this article we explain when loss of profit exists in partial reopening situations, what insurers usually dispute, and how to claim properly.

What is considered partial reopening after a loss

We talk about partial reopening when the business: • is open to the public but cannot provide its usual services • operates with technical or structural limitations • generates income, but well below normal levels

This commonly happens after: • fires • floods • DANA events • severe water or smoke damage

The key point is not whether the shutters are up, but whether the business can operate normally.

Real-life cases of partial reopening with loss of profit

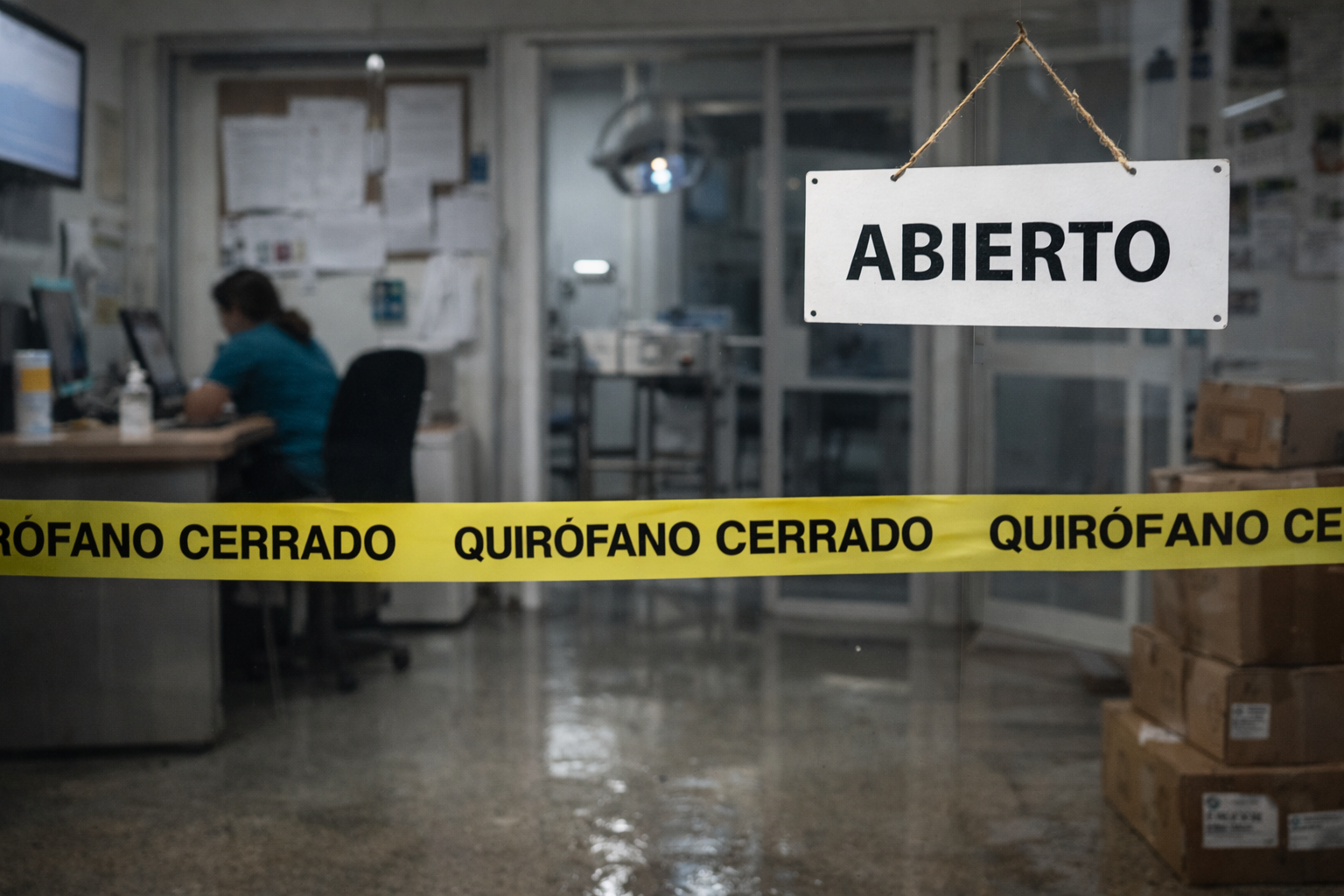

Veterinary clinic after a DANA event In a recent case, a veterinary clinic affected by a DANA was able to reopen, but could not perform surgeries because the operating room and essential equipment were unavailable.

The business: • attended basic consultations • carried out check-ups • could not invoice surgical procedures, which represented a significant part of its turnover

The insurer argued that:

“the activity was not completely stopped.”

The claim was supported by: • delays in replacing specialised equipment • emails from suppliers affected by the DANA • access and supply chain disruptions • direct impact on surgical revenue

As a result, a real loss of profit was recognised despite the business being open.

Restaurant offering delivery but with reduced turnover Another frequent case after a DANA: a **restaurant could operate via delivery platforms, but could not serve customers on-site normally.

The insurer claimed:

“the business could still sell online.”

However: • turnover dropped to 70% compared to comparable months • the policy included loss of profit coverage below a defined threshold

In this case, the policy provided €300 per day for up to 100 days, which was successfully applied.

What insurers usually argue in these cases

Typical insurer arguments include: • “the activity was not fully interrupted” • “online sales were possible” • “this was a business decision” • “repairs could have been completed sooner” • “the loss is not that significant” • “the comparative data is not reliable”

These arguments do not automatically close the case, but they require a well-structured technical and documentary response.

Turnover thresholds: a key factor

Many policies recognise loss of profit when: • turnover falls below 60% or 80% • compared to equivalent periods

These thresholds are usually defined in the policy conditions and must be reviewed case by case.

Self-employed businesses: where disputes are most common

The toughest disputes often involve: • self-employed professionals • small businesses • family-run shops

Many reopen early because: • they need income to survive • they cannot afford a full closure • they operate under suboptimal conditions

Opening “as best as possible” does not mean waiving loss of profit. In many cases, partial reopening actually increases the financial loss.

Link with material damage

Loss of profit is directly linked to: • the real extent of material damage • actual repair times • availability of equipment and supplies

If material damage is undervalued, loss of profit will usually be underestimated as well.

Fires, floods and DANA: the most common scenarios

Loss of profit due to partial reopening is most common after: • fires in business premises • floods • DANA events

Relationship with underinsurance

Even when loss of profit is correctly calculated, another issue may arise: underinsurance.

If the insured sum is insufficient, the insurer may apply the proportional rule and reduce the indemnity.

⸻

What the insured can do to claim correctly

In cases of partial reopening, the insured should: • formally request the opening of the loss of profit claim • properly document the drop in revenue • justify ongoing fixed costs • compare equivalent accounting periods • challenge unrealistic repair timelines • avoid accepting premature claim closures

Conclusion

Partial reopening does not automatically eliminate loss of profit. What matters is not whether the business is open, but whether it can operate as it did before the loss.

A well-prepared claim can make the difference between absorbing unjust losses or receiving proper compensation.

Fecha de creación: 2025-11-11

Última edición: